Australia’s Trusted Credit Repair Experts

BEST Credit Repair Experts – Defaults, Errors, Judgments & Debt Negotiation

One of the Best Credit Repair Services in Australia | Fast & Reliable

We Are an ASIC-Licensed, Fully Regulated Credit Repair Company in Australia

Improve Your Credit Score for Home Loans, Car Loans, and Approvals

Multi-Award Finalists for Excellence in Credit Repair & Financial Services

Leading Credit Repair Experts – Remove Defaults, RHI, Errors & Court Judgment, and Debt Negotiation

Your credit score matters

The average credit score in Australia is 695 however 853 or higher increases your borrowing power.

Why is that a good thing?

1 in 4 chance of error

There is a 1 in 4 chance that your credit report has an error that needs correcting.

Boost your credit score

Repairing your credit report helps to boost your credit score.

Become 'mortgage ready'

Health check your credit score & report to make sure you're on the right path to be offered a lower interest home loan.

Lower your interest rates

Refinance and consolidate your loans to lower and save on interest.

We guarantee we will improve your credit report - or your money back*

How To Improve Your Credit Score

Our professional team has over 24 years experience in finance & credit repair.

Getting started is simple!

STEP ONE

Contact us by filling in the 'apply now' form, including a personal story so we can understand your case. Or call us directly. Call 1800 956 694 or admin@creditsuccess.com.au.

STEP TWO

Credit Success will review your application or enquiry, and one of our friendly team members will contact you within 24 hours by calling you contact number. If we are unable to get hold of you, we will send you an email for follow up.

STEP THREE

Once we have discussed your case with you and confident we are able to take on your case. We will send you our link to our application and privacy forms to get started. The process in repairing your credit report can take up to 8 weeks for more complicated cases.

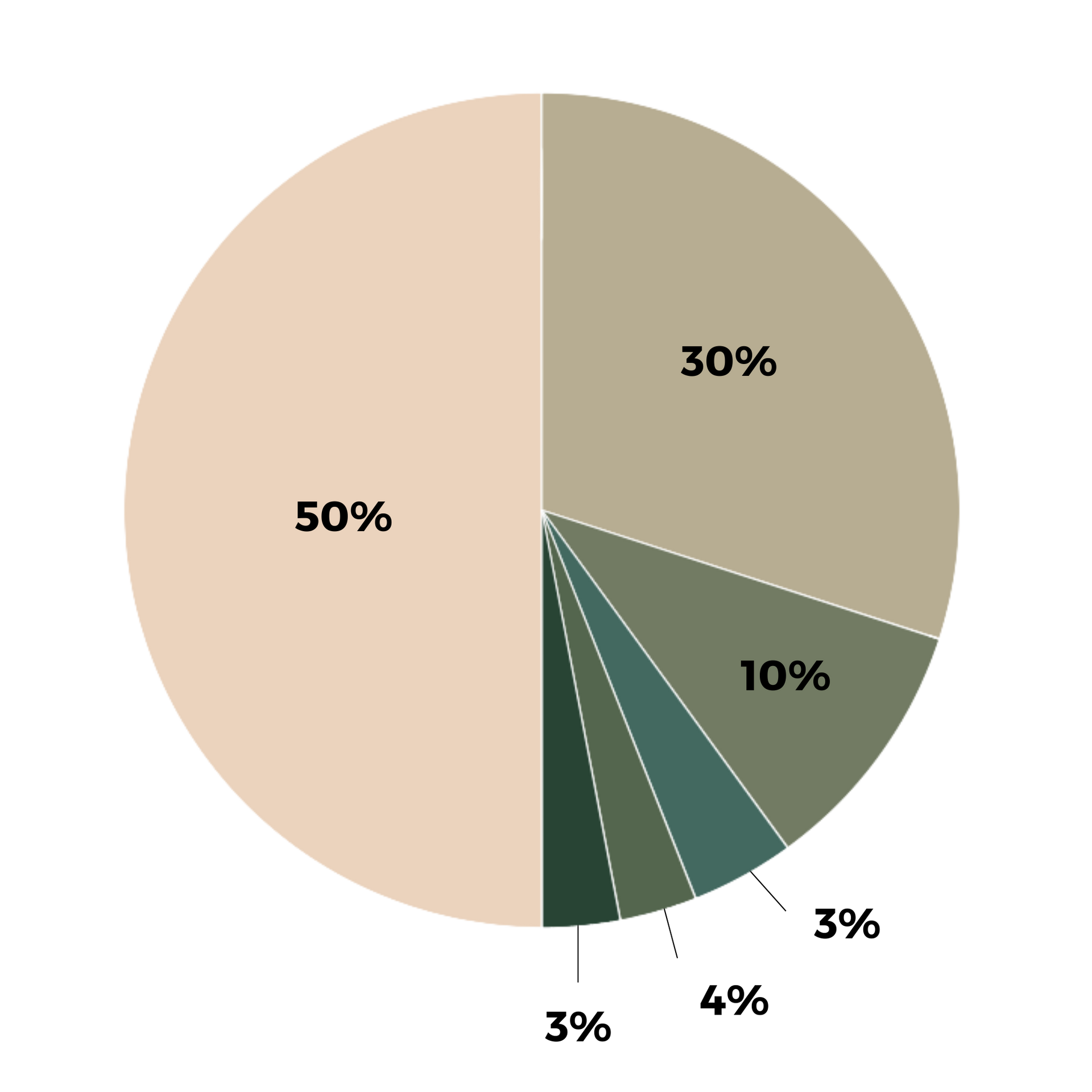

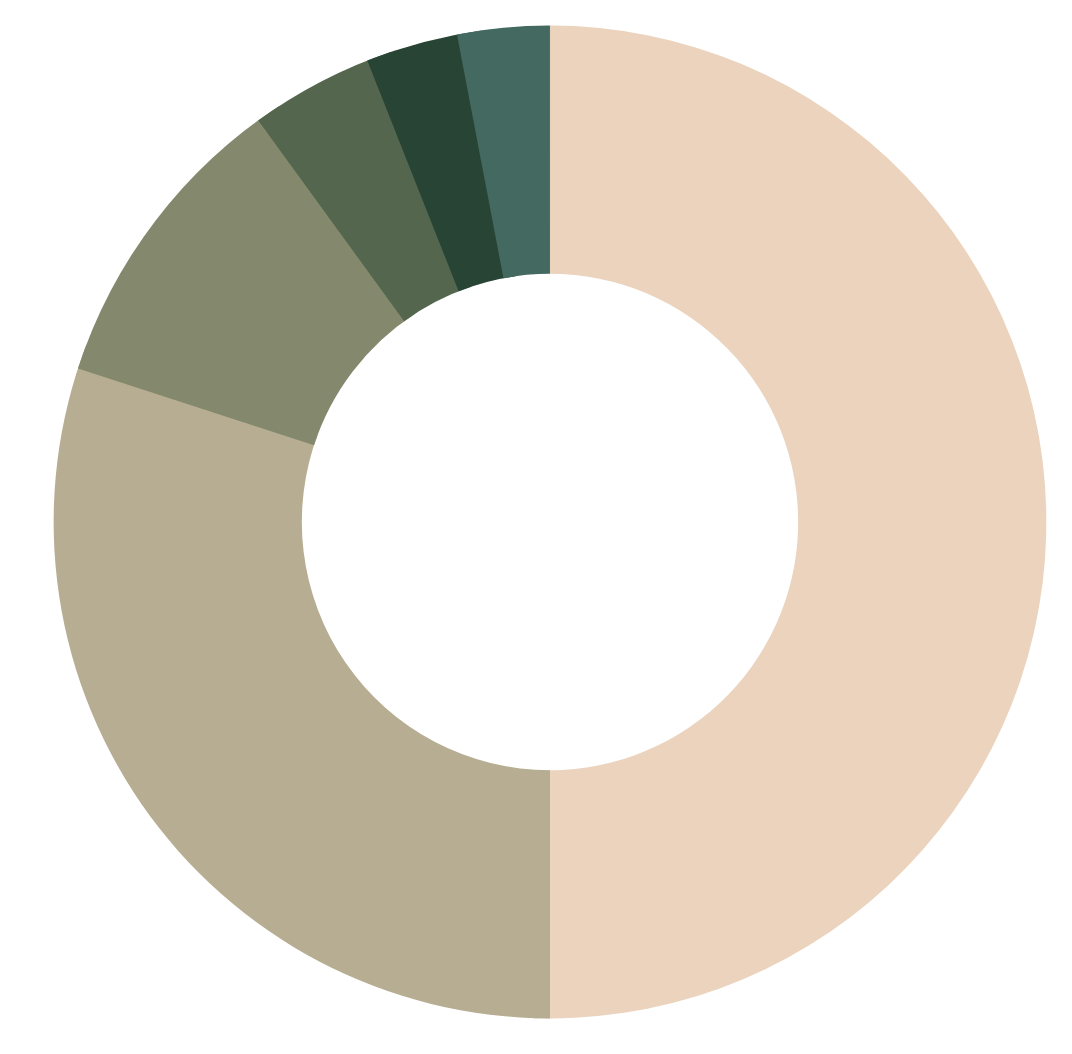

What contributes to your credit report?

Your credit report is based off a combination of factors and determined by credit bureau assessments